Monday, March 2, 2009

Now the Forbes list has become the wanted list... in China

From The Sunday Times

http://www.timesonline.co.uk/tol/news/world/asia/article5821943.ece

March 1, 2009

Tycoons tumble as ailing China turns against capitalism

How the dream has gone sour for those who got rich on the back of political patronage - then lost it

Michael Sheridan, Far East Correspondent

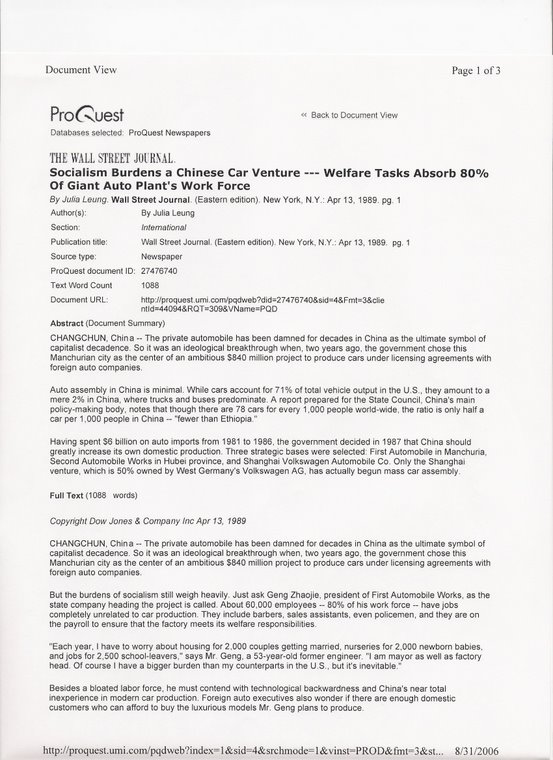

THE richest man in China has ended up in police custody and other “red billionaires” have plunged into debt or political disgrace as the communist nation’s flirtation with capitalism turns sour.

Meanwhile, millions of ordinary Chinese have lost their shirts in the stock market after share prices collapsed, and at least 20m workers have lost their jobs due to the recession.

In this atmosphere, the plight of Huang Guangyu, 39, has won little public sympathy. He is still languishing in detention after three months, while investigators probe allegations of bribery and irregular share trading.

Huang was a peasant’s son who built up a successful electrical appliance chain until it had 800 stores and he had shares worth £2 billion.

Related Links

On paper, he lived out the line that “to get rich is glorious”, a slogan that seduced foreign investors to pour billions into China, persuading themselves that it was not really a socialist dictatorship.

Business magazines wrote profiles lauding Huang as the paramount genius among China’s 391,000 dollar-millionaires. As usual in China, Huang’s ascent and his downfall seem to have coincided with influence wielded by powerful men inside the government bureaucracy.

“There’s a grey area between planned economy and market economy, in which government officials wield power and businessmen bribe them,” said Professor Liu Xue of Beijing University in the China Youth Daily.

Last November, Huang, his wife, and their chief financial officer disappeared into the grey zone that awaits those who lose their high-level protection – a world without lawyers, court hearings or constitutional rights. Huang’s net worth has crumbled. While he sits in detention, lawyers and accountants in Hong Kong try to save the company, whose shares remain suspended. He is, of course, no longer the richest man in China.

In the boom years, ordinary Chinese people watched a handful of businessmen and officials enjoying a hitherto unimaginable lifestyle of mistresses, banquets, luxury cars and foreign holidays. Public anger over rampant official corruption is now turning to class hatred as one tycoon after another ends up in prison or pleads for a bailout from friends in high places.

Protesters against graft and injustice took to the streets of Beijing last week ahead of the annual National People’s Congress. Angry citizens published an open letter demanding that the Communist party’s central disciplinary committee investigate the nation’s top property developer. “Billionaires in China blindly rely on political power,” complained blogger Chen Jinsong.

Resentment has been fuelled by the exalted levels of patronage that seem to have saved the most Anglophile of the Chinese magnates, Larry Yung, from financial embarrassment.

Yung, 66, is the grandson of a prerevolutionary Shanghai tycoon and the son of a vice-president of the People’s Republic of China. He made a fortune in Hong Kong as the public face of Citic, the first overseas investment arm of the Chinese government. With wealth came racehorses, a stewardship of the Royal Hong Kong Jockey Club and the ownership of Birch Grove, Harold Macmillan’s former country home in West Sussex.

But last summer a Citic subsidiary made a wrong-way bet on a derivatives trade in the Australian dollar that could cost it up to £1.6 billion. Shares in the subsidiary have fallen almost 80%. Its financial director and controller were fired, although Yung’s daughter, who worked for them, kept her job. The Hong Kong authorities are investigating the affair. Yung flew to Beijing and secured a bailout from his masters on the Central Committee of the Communist party.

Another casualty is Zhang Yin, 51, once hailed as the richest woman in China and one of only 10 self-made female billionaires in the world. Shares in Zhang’s paper company, Nine Dragons, collapsed by some 90% as Chinese exports slumped and so did demand for its recycled boxes.

There has been public glee at her misfortune because, to many Chinese, she is the unacceptable face of capitalism. Last year she used her position on the Chinese People’s Political Consultative Conference to lobby for tax cuts for the rich and to try to block a new labour law aimed at ending sweatshop exploitation.

It was a costly blunder. Left-wingers unleashed the state media to tear into Zhang, reporters soon uncovered employment abuses and tax officials have been urged to investigate her.

Chinese billionaires are uniquely vulnerable to investigations for tax evasion and illegal land scams, said Zhao Xiao, a researcher at a state think tank, in an interview with a Chinese newspaper.

“Now the Forbes list has become the wanted list,” he said.

http://www.timesonline.co.uk/tol/news/world/asia/article5821943.ece

March 1, 2009

Tycoons tumble as ailing China turns against capitalism

How the dream has gone sour for those who got rich on the back of political patronage - then lost it

Michael Sheridan, Far East Correspondent

THE richest man in China has ended up in police custody and other “red billionaires” have plunged into debt or political disgrace as the communist nation’s flirtation with capitalism turns sour.

Meanwhile, millions of ordinary Chinese have lost their shirts in the stock market after share prices collapsed, and at least 20m workers have lost their jobs due to the recession.

In this atmosphere, the plight of Huang Guangyu, 39, has won little public sympathy. He is still languishing in detention after three months, while investigators probe allegations of bribery and irregular share trading.

Huang was a peasant’s son who built up a successful electrical appliance chain until it had 800 stores and he had shares worth £2 billion.

Related Links

On paper, he lived out the line that “to get rich is glorious”, a slogan that seduced foreign investors to pour billions into China, persuading themselves that it was not really a socialist dictatorship.

Business magazines wrote profiles lauding Huang as the paramount genius among China’s 391,000 dollar-millionaires. As usual in China, Huang’s ascent and his downfall seem to have coincided with influence wielded by powerful men inside the government bureaucracy.

“There’s a grey area between planned economy and market economy, in which government officials wield power and businessmen bribe them,” said Professor Liu Xue of Beijing University in the China Youth Daily.

Last November, Huang, his wife, and their chief financial officer disappeared into the grey zone that awaits those who lose their high-level protection – a world without lawyers, court hearings or constitutional rights. Huang’s net worth has crumbled. While he sits in detention, lawyers and accountants in Hong Kong try to save the company, whose shares remain suspended. He is, of course, no longer the richest man in China.

In the boom years, ordinary Chinese people watched a handful of businessmen and officials enjoying a hitherto unimaginable lifestyle of mistresses, banquets, luxury cars and foreign holidays. Public anger over rampant official corruption is now turning to class hatred as one tycoon after another ends up in prison or pleads for a bailout from friends in high places.

Protesters against graft and injustice took to the streets of Beijing last week ahead of the annual National People’s Congress. Angry citizens published an open letter demanding that the Communist party’s central disciplinary committee investigate the nation’s top property developer. “Billionaires in China blindly rely on political power,” complained blogger Chen Jinsong.

Resentment has been fuelled by the exalted levels of patronage that seem to have saved the most Anglophile of the Chinese magnates, Larry Yung, from financial embarrassment.

Yung, 66, is the grandson of a prerevolutionary Shanghai tycoon and the son of a vice-president of the People’s Republic of China. He made a fortune in Hong Kong as the public face of Citic, the first overseas investment arm of the Chinese government. With wealth came racehorses, a stewardship of the Royal Hong Kong Jockey Club and the ownership of Birch Grove, Harold Macmillan’s former country home in West Sussex.

But last summer a Citic subsidiary made a wrong-way bet on a derivatives trade in the Australian dollar that could cost it up to £1.6 billion. Shares in the subsidiary have fallen almost 80%. Its financial director and controller were fired, although Yung’s daughter, who worked for them, kept her job. The Hong Kong authorities are investigating the affair. Yung flew to Beijing and secured a bailout from his masters on the Central Committee of the Communist party.

Another casualty is Zhang Yin, 51, once hailed as the richest woman in China and one of only 10 self-made female billionaires in the world. Shares in Zhang’s paper company, Nine Dragons, collapsed by some 90% as Chinese exports slumped and so did demand for its recycled boxes.

There has been public glee at her misfortune because, to many Chinese, she is the unacceptable face of capitalism. Last year she used her position on the Chinese People’s Political Consultative Conference to lobby for tax cuts for the rich and to try to block a new labour law aimed at ending sweatshop exploitation.

It was a costly blunder. Left-wingers unleashed the state media to tear into Zhang, reporters soon uncovered employment abuses and tax officials have been urged to investigate her.

Chinese billionaires are uniquely vulnerable to investigations for tax evasion and illegal land scams, said Zhao Xiao, a researcher at a state think tank, in an interview with a Chinese newspaper.

“Now the Forbes list has become the wanted list,” he said.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment