Dear Colleagues,

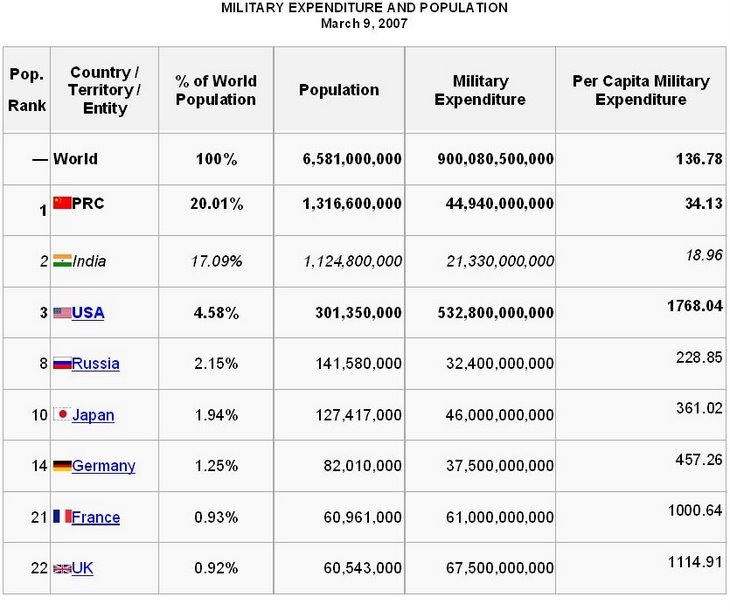

I am elated to be in a position to share with you articles from China in the English version of their magazine Beijing Review. The articles deal with the handling of the economic crisis that capitalism has foisted on them. They had relied too much on the export market in their economic growth rather than focusing on increasing domestic consumption. I believe they have learned their lesson and are now using the social capital available to them to facilitate their move down the socialist road and change their basic economic plan and market and banking regulations to foster domestic consumption which means taking care of their people's condition. I think they will succeed.

These three articles which I am now sending to you give you information which indicates their current thinking forced by the real conditions of a changing world in the 21st century. We are truly moving in a bipolar world. The strength of China's industrial, economic and social development and their relations with developing countries around the world will guarantee growth in spite of the financial capital which has dominated globalization. I believe we will see in the coming meeting of the G-20 that new directions will develop dealing with the relationship between the two poles of economic life for nations all over the world. I would like your comments after you've had an opportunity to digest this material.

CRISIS FOCUS: Forex Reserves to The Rescue -- Beijing Review

Positively Convinced -- Beijing Review

Re-employment Is Crucial -- Beijing Review

Sincerely,

Sidney J. Gluck

SJGluck@aol.com

UPDATED: March-16-2009 NO. 11 MAR. 19, 2009

CRISIS FOCUS: Forex Reserves to The Rescue

http://www.bjreview.com.cn/print/txt/2009-03/16/content_185302.htm# When Premier Wen Jiabao told this year's World Economic Forum in Davos that the Chinese Government was exploring more efficient ways to use its massive foreign exchange (forex) reserves to boost the domestic economy, he emphasized that the reserves could only be used overseas.

Zuo Xiaolei, Chief Economist of Beijing-based China Galaxy Securities Co. Ltd., recently wrote an article in the Securities Times explaining why the country's forex reserves can only be used overseas and how they can help stimulate domestic development. Edited excerpts follow:

China's forex reserves are assets of the People's Bank of China, China's central bank, instead of assets of the Ministry of Finance. The central bank purchased them from enterprises and individuals through issuing more domestic currency, the yuan. Any proposal involving spending China's forex reserves to boost domestic economy would require converting them into yuan. If more yuan is issued, it would increase the domestic money supply and finally provoke domestic inflation.

All in all, forex reserve assets have their real purchase power in overseas markets, and that's why Premier Wen said forex reserves could only be used overseas.

Also, it is unfeasible to hand out China's huge forex reserve assets to the people to boost domestic consumption. If the Chinese spend $1 trillion buying goods or services at home, they will first convert the money into yuan. The $1 trillion comes back to the central bank again. Worse still, the central bank has to buy back the $1 trillion for the second time, which means it will issue another sum of yuan equal to $1 trillion. If the Chinese spend the money overseas, it won't directly stimulate the country's domestic economy, and the central bank will lose $1 trillion of its forex reserve assets. Either way will give rise to a currency crisis or inflation and the depreciation of the yuan.

Through the proposal of backing up domestic development with huge forex reserves, Premier Wen expressed the Chinese Government's confidence in reviving the economy. It indicates China still has room for maneuvering and is able to adopt measures other than printing more money to ride out the crisis.

China's forex reserves, which hit a record $1.95 trillion at the end of 2008, ensure that the country has a strong capacity for external payments and will help to stabilize foreign direct investments and prevent large capital outflows.

Furthermore, a large forex reserve base will promote an increase in domestic investments by driving imports of, say, technology, machinery and equipment. It not only will boost China's economic growth, but also serve as an active response to issues of global concern such as environmental protection and global warming, if the technology and equipment we import are eco-friendly and energy efficient.

When China imports more, it also will benefit the economies of exporters. China can make a larger contribution to the revival of the global economy if the exporters lift restrictions on technology and certain goods exported to China.

***********************

UPDATED: March-13-2009 NO. 11 MAR. 19, 2009

http://www.bjreview.com.cn/print/txt/2009-03/13/content_185303.htmPositively Convinced After reporting a sharp slowdown in the fourth quarter of 2008, the country's next step on the path to recovery is coming into focus

With sharp recessions on the way, the world is looking to China for some confidence. But the Chinese economy has its own woes-its drastic decline in exports and a looming economic imbalance have yet to be redressed. After reporting a sharp slowdown in the fourth quarter of 2008, the country's next step on the path to recovery is coming into focus. Premier Wen Jiabao's government work report outlined a national campaign to turn around the slowing economy.

Deputies to the 11th National People's Congress (NPC) and members of the 11th National Committee of the Chinese People's Political Consultative Conference (CPPCC) provided suggestions and comments about the economy.Here are some selected summaries of their opinions.

Confident About Overcoming The Crisis

Yuan Chunqing, deputy to the 11th NPC and Governor of Shaanxi ProvinceThe government work report of the State Council proposes dealing with the global financial crisis in an active and sound way. With the theme of sustaining economic growth, the report lays out a series of plans to stimulate economic growth.

Shaanxi has set its goal for economic growth at 13 percent in 2009. We have the foundation and conditions to realize such a goal. In the past five years, the economy in our province grew at an average annual rate of 12 percent. Last year, the economic growth in Shaanxi grew 15.6 percent, ranking fourth in the country. This has allowed us to accumulate strong power for continuously fast development in future years. Most of Shaanxi's leading industries are developed based on local resources. Because there are many large companies and large groups, they are more capable of fending off risks. As the state expands its input in infrastructure construction and public services, Shaanxi has wide space and potential for further development.

This year we will make efforts mainly in the following areas. In terms of investment, we will start a new round of major project construction, and fixed-asset investment may reach 630 billion yuan ($92.11 billion), up more than 30 percent.

Industry will be the key sector to sustain economic growth. The chemical industry is the major force to drive the development of the energy and chemical industries, and a number of major resource exploitation and deep processing projects will be constructed. Xi'an Aircraft Industry (Group) Co. Ltd. will play a leading role in China's large aircraft manufacturing and the development of feeder liners, and will drive the development of other related industries. The development of emerging hi-tech industries such as photovoltaic and semiconductor illumination will be stressed, and efforts in innovation will be strengthened.

The level and scale of inviting foreign investment will be improved.

Investment in projects related to people's livelihoods will be expanded to 40 billion yuan ($5.85 billion), an increase of 21 percent over the previous year, and will drive up economic growth while enhancing the level of public services.

We will set up 100 county-level industrial parks, accelerate the industrialization process in counties, support the development of 50 key townships in south and north Shaanxi, and accelerate urbanization in rural areas.

Central and Western Regions

Li Youzhi, deputy to the 11th NPC and Director of the Department of Finance of Hunan ProvinceCentral and western regions are still underdeveloped. The process of industrialization and urbanization is backward, and the proportion of secondary and tertiary industries is low. Hence these regions are less affected by the global financial crisis than the eastern region. Moreover, with vast area and large population, the central and western regions have huge potential to expand domestic demand.

The Central Government should pursue a policy favoring the central and western regions in designing systems, arranging major projects, making policy and allocating funds. For people living in central and western regions, the most urgent demand is to improve education and health care security to stimulate their consumption.

Spending Money on People

Tian Xirong, deputy to the 11th NPC and Secretary of the Shuozhou Municipal Committee of the Communist Party of China, Shanxi ProvinceThe government should be generous in spending money on people, because it can obtain the maximum benefit, directly enhance economic expectations, improve social confidence and increase tangible consumption. The government should concentrate on its budgetary input in housing construction, compulsory education, ecological environment and farmers' consumption.

After reporting a sharp slowdown in the fourth quarter of 2008, the country's next step on the path to recovery is coming into focus

I have four suggestions: First, we should accelerate urbanization construction, particularly the mass construction of affordable houses and low-rent houses in small and medium-sized cities to provide affordable living conditions for migrant workers and new university graduates. Real estate is one of the few industries highly related to other industries and can drive a large amount of social investment. For example, after buying houses, migrant workers and university graduates will also buy furniture, home appliances and telecommunications products.

Second, compulsory education in a real sense should be carried out in urban and rural areas; that is, families do not need to pay anything while the government pays all education expenses. This measure not only would ease the education burden on families, but also would improve people's quality.

Third, the government should make great efforts to resolve the problems of providing social security for the elderly, health care and unemployment insurance, and make steady progress.

Fourth, the central and western regions should be generous in investing in the ecological environment and providing jobs as a form of relief.

Old Industrial Bases

Cao Xinping, deputy to the 11th NPC and Mayor of Xuzhou, Jiangsu ProvinceThere are many old industrial bases in China. In coping with the financial crisis, they should attach great importance to upgrading and transforming themselves.

The extensive economic growth pattern, especially the irrational economic structure, is the main crux of the problem in China's economic development. The global financial crisis has exposed the weak points more clearly. At present, China faces not only the challenges of declining external demand, but also the pressures of increasing restrictions from resources and the environment, growing labor and land costs, as well as the onset of international protectionism. Our traditional competitive advantages are gradually weakening. The economic growth pattern with its advantages of resources, the environment and low prices cannot last and must be abandoned.

As an old industrial base, Xuzhou has been exploring ways to upgrade and promote the transformation of an economic growth pattern focusing on structural adjustments. Some new and strong industries have been developing fast. The process of coping with the global financial crisis has also brought strategic opportunities for the upgrading and transformation of Xuzhou.

At present, Xuzhou is focusing its efforts on three areas to emerge from the crisis. First, it is expanding effective input in government investment-led projects so as to make full play of the role of government and attract more social investment. Second, it is strengthening the government's efforts to serve the market and companies, and doing its best to help enterprises solve their problems. Third, it is attaching great importance to people's livelihoods and solving serious problems that influence their production and daily lives.

Raising Farmers' Enthusiasm For Growing Grain

He Zhusheng, deputy to the 11th NPC and resident of Houying Village, Yingluo Town, Haicheng of Liaoning ProvinceNow it is more difficult for farmers to continuously increase their incomes. The low grain price is the main reason, which has affected farmers' enthusiasm for growing grain.

The grain issue is of great significance to the national economy, people's livelihoods and the state's stability. I suggest the state further increase direct subsidies for growing grain and increase the purchasing price of grain in order to increase farmers' enthusiasm for growing grain. This can not only increase farmers' income, but also stimulate consumption by farmers, and hence drive up domestic demand and contribute to maintaining economic growth.

I suggest the government reform the policies on direct subsidies for growing grain and purchasing farm machines and tools. Under market economy conditions, the state should pay high attention to private agricultural goods companies and farm product processing enterprises. The government should treat these private companies and state-owned enterprises of the same kind equally and create an environment of fair competition. It should not levy too many charges for farmers who establish small factories and build workshops. Only when farm product processing companies have good business can grain prices rise and farmers' enthusiasm for growing grain increase.

Culture Industry's Role

Li Li, deputy to the 11th NPC and President of the Shanxi Vocational College of ArtsThe Shanxi Vocational College of Arts has performed the dance drama Wild Jujube nearly 600 times at home and abroad since 2002. The economic benefits of such entertainment and its role in boosting consumption are evident.

After reporting a sharp slowdown in the fourth quarter of 2008, the country's next step on the path to recovery is coming into focus

The global financial crisis has also brought opportunities for the culture industry, because in a slumping social environment, people feel more pressure in various respects, and they need more relaxation and confidence. This is what the culture industry can provide. Data show that since this January, China's culture industry has grown 15-18 percent. In some fields, growth has even reached 30 percent.

Therefore, the government must vigorously develop the culture industry to drive up domestic demand. First, it should formulate some policies for the culture industry during the special period, such as formulating tax policies to support the culture industry and reduce ticket prices for commercial performances. Second, it should establish and improve the government-led investment and financing mechanism for the culture industry to thoroughly solve its financing difficulties. Third, the government should participate in the creation of large cultural companies.

Managing Local Financing Platforms

Zhang Binggong, deputy to the 11th NPC and Commissioner of the National Auditing Office in ChongqingThe Central Government plans to invest 1.18 trillion yuan ($172.51 billion) within two years, creating up to 4 trillion yuan ($585 billion) in local and social investments. A large portion of these funds must be raised by local governments and companies. Under these circumstances, the investment and financing platforms of local governments will play an important role.

In recent years, local governments have established investment and financing platforms such as investment companies and asset management companies, mainly serving urban infrastructure construction, small and medium-sized enterprises and education financing. These platforms have made significant contributions to local economic and social development, but still have problems and risks during operation.

For asset safety, banks are willing to grant loans to government-led projects. If local governments have fiscal difficulties and cannot invest enough funds in the projects, bank capital has to play the role of fiscal funds, thereby increasing the banks' risk of having nonperforming loans and endangering financial safety. During this round of massive investment to maintain economic growth, problems in local investment and financing platforms may become distinctly evident.

Therefore, I suggest the state formulate regulations on local investment and financing platforms and establish mechanisms for pre-warning and preventing risks as soon as possible.

Not So Bad After All

Li Yining, Vice Chairman of the Committee for Economic Affairs under the 11th CPPCC National CommitteeThe work report delivered by Premier Wen Jiabao confirmed the government's commitment to holding up domestic growth and also outlined a national campaign to contain the ripple effects of the global financial storm.

Obviously, China has learned the lesson from other countries that a sluggish response to the downturns delays the restoration of confidence. By making sizeable investments in infrastructure and social welfare, the country is gearing up to pick up some of the slack in the export sector.

Given the enormous scale of the stimulus package, I believe the target of 8-percent growth for this year is achievable. Although it is far from clear whether the export sector has put the worst behind it, domestic demand will be able to provide an expected spur to GDP growth. But the infrastructure spending spree should not overshadow the much needed shift in China's growth model towards domestic consumption and services, which would be more sustainable in both economic and environmental terms.

One looming concern is that the drop in exports is exacting a heavy toll on employment, which holds the key to social stability. The target of creating 9 million new jobs this year, reiterated in Premier Wen's work report, will not be easy to fulfill as there will be some lag before the economic recuperation works through the job market.

After reporting a sharp slowdown in the fourth quarter of 2008, the country's next step on the path to recovery is coming into focus

To firm up employment, the government is supposed to further support labor-intensive private enterprises, which are the biggest employers, and at the same time provide more vocational training for returning migrant workers.

Rural Prosperity

Chen Xiwen, Vice Chairman of the Committee for Economic Affairs under the 11th CPPCC National Committee and Director of the Office of the Central Leading Group on Rural WorkThe subdued prospects for economic growth have increased the importance of bolstering domestic consumption, and rural consumption in particular. A basket of spending plans to upgrade rural infrastructure, subsidize appliance purchases for farmers, and extend rural access to healthcare and schooling will boost farmers' livelihoods and spending power. The countryside will also gain momentum from policies to increase the minimum purchase prices of grains and expand government and commercial reserves of food.

The severe drought in north China earlier this year will not put much of a dent in China's grain output, because the winter harvest makes up only around one fifth of the total. The government's timely drought-relief efforts have also helped ease the pain.

Currently, about 20 million rural migrants have lost their jobs as a result of the export collapse that drained life from the world's third largest economy. But the number has not showed signs of escalating, because many factories reopened after the Spring Festival and absorbed some of the workforce. As Premier Wen's work report highlighted, the government is acting swiftly to help them get reemployed or start up their own businesses. With more favorable policies coming into play, the country's job market is bound for a rally.

Fiscal Lifeline

Jia Kang, member of the 11th CPPCC National Committee and Director of the Research Institute for Fiscal Science under the Ministry of FinanceThe strong increase in fiscal spending for 2009 plus its leverage effect should provide a floor under the slackening economy. The easing monetary environment and revitalization programs for the 10 backbone sectors will also pump steam into the industries.

In recent weeks, there have been initial signs of the economy starting to find its footing after a slowdown in the fourth quarter of 2008. New domestic currency lending has surged since November and hit a record 1.6 trillion yuan ($234 billion) in January, while power consumption in the eastern coastal provinces rebounded in February. But it remains to be seen whether these signs will turn into a more sustainable trend. Even if not, China still has plenty of scope to jumpstart the economy later this year.

According to the work report of Premier Wen, China's national budget deficit will jump more than sevenfold this year to 950 billion yuan ($139 billion), still below the international threshold of 3 percent of GDP. The United States, by comparison, is budgeting for a deficit of 12.3 percent of its GDP. However, policymakers should take a cautious approach to more tax waivers for absolute fiscal safety.

Compared with other countries, China has several potential advantages in economic resilience-relatively cheap labor and a buoyant domestic market, as well as unmatched budget flexibility. Those advantages will translate into real growth with the help of the stimulus measures.

Enough Stimuli

Li Deshui, member of the 11th CPPCC National Committee and former Commissioner of the National Bureau of StatisticsAs the work report of Premier Wen indicated, this year will see a heady investment boom in China to offset the export contraction that is bearing down the economy. For a country like China, which is well positioned to turn around the current gloom, the goal of 8-percent growth this year is reasonable and realistic.

But we should draw a clear line between China's economic slowdown and the deep recessions of Western countries. The Chinese economy grew a modest 6.8 percent in the fourth quarter of 2008-the worst record in seven years-but was still the envy of Western countries sinking into deep recessions. Moreover, Chinese banks made an outpouring of loans this January to buck up economic growth while many of their Western counterparts were struggling to thaw a credit freeze.

That's why I believe extra stimulus measures beyond the 4-trillion-yuan ($586-billion) package are unnecessary. Premier Wen's work report underscored a considerable fiscal expansion, which combined with the credit boom will result in the vibrant stimulus we need.

More importantly, the fiscal package also adequately targeted new growth drivers, such as the consumer market and the service sector. This is crucial to rebalancing the growth model and polishing long-term economic prospects.

China's per-capita GDP surpassed $3,000 in 2008, signaling an accelerated urbanization and industrialization process to come. This also fosters a favorable economic climate for us to propel growth and restructure the economy.

Aiding SMEs

Yu Kwok-chun, member of the 11th CPPCC National Committee and General Manager of Hong Kong Yue Hwa Chinese Products Emporium Ltd.Chinese small and medium-sized enterprises (SMEs) employ the majority of workers-three out of four. They are also a big contributor to GDP growth. Now, with a shaky employment landscape in sight, policymakers are painfully aware of the importance of keeping smaller businesses afloat. But the question is how to warm up their souring business mood while overseas markets continue to buckle. Personally, I believe the following measures could be instrumental in aiding the beleaguered SMEs.

First, the government should prompt commercial banks to increase financing support to vulnerable SMEs whose supply chains have broken down because of a lack of cash. The banks' willingness to lend to SMEs is at its lowest level because of a risk-averse sentiment amid the downturns. Other options available include improving the guarantee system for funding SMEs and pushing ahead with the development of rural banks and microcredit.

Second, SMEs should be offered a chance to participate in the massive infrastructure projects that will generate juicy returns.

Third, the SMEs themselves should also make efforts to innovate their outdated technologies and old management modes so they are not forced out of the market in cutthroat competition. Meanwhile, they should also attach importance to brand promotion for a firm foothold at home and abroad.

Fourth, SMEs should be responsible for strengthening vocational training for their employees. This would help mitigate employment stress and also benefit the enterprises.

********************

UPDATED: March-14-2009 NO. 11 MAR. 19, 2009

Re-employment Is Crucial http://www.bjreview.com.cn/print/txt/2009-03/14/content_185306.htmA large number of migrant workers in southeastern coastal areas are returning home because of factory closures and production suspension

The U.S.-led global financial turmoil is weighing down China's real economy, which has relied heavily on exports of labor-intensive products for growth. China's employment suffers when the world economy succumbs to a recession. A large number of migrant workers in southeastern coastal areas are returning home because of factory closures and production suspension. Du Yang, a labor expert at the Institute of Population and Labor Economics under the Chinese Academy of Social Sciences, published an article in China Finance that argued boosting employment, especially in rural areas, should be the primary goal of economic recovery. Edited excerpts follow:

Both central and local governments have made a series of policies to stimulate economic growth amid the global economic downturn. But those policies do not offer detailed measures to expand employment. In my opinion, an economic stimulus package that does not take into consideration job creation cannot root out the negative influence imposed by the financial crisis.

As China merges into economic globalization, any outside blow will cause sharp fluctuations in the Chinese economy, which can also be reflected in the labor market.

The 1997 Asian financial storm, a smaller version of this round of financial crisis, resulted in deteriorating economic growth and rising job losses. The Chinese Government at that time adopted active employment policies while in the meantime perfected the urban social security system.

The current financial turmoil has engulfed the Chinese labor market in the same predicament. Worse still, the crisis originated in developed countries, which absorb most of the cheap "made-in-China" products, hence taking a toll on labor-intensive Chinese producers.

However, this time, instead of urban employees, migrant workers who have relocated to the southeastern coastal regions have suffered the most from the destructive financial crisis. They not only have lost their low-paying jobs, but also are not covered by the social security network, adding uncertainty to social stability.

Unemployment imposes direct negative impacts on people's livelihoods, giving rise to social instability if a huge number of people cannot make ends meet because of job losses.

As a result, job growth should be at the top of the macro-control agenda.

In the government stimulus plans, more money seems to be allocated to infrastructure construction and large conglomerates. Those are useful to boost investment but will not effectively increase jobs or expand consumption.

To achieve an economic recovery with job growth, more stimulus measures should be granted to small and medium-sized enterprises (SMEs), which are important absorbers of excessive labor in many economies.

More financial support should be given to SMEs to create a better development environment for them such as relieving their tax burden and increasing credit support if they are beset by financial problems.

Perfecting social security

To better survive the financial turbulence, we should combine active job expansion with optimized social security.

Last December, the Central Economic Work Conference proposed to "implement a proactive employment policy," which was right in time to tackle unemployment. A decade ago, we successfully weathered the Asian financial storm by actively expanding employment. This time, employment expansion must focus on the group that has been hit the hardest by the crisis-migrant workers.

A large number of migrant workers in southeastern coastal areas are returning home because of factory closures and production suspension

As I mentioned above, migrant workers are suffering the most from the economic recession. In recent years, more people have chosen to work on flexible schedules. According to our research, two thirds of migrant workers-about 90 million-are seasonal labors, whose employment status is hard to track given the current statistical system. Therefore, their job losses are most likely to be underestimated.

Not many migrant workers are covered under the social security net. Because most of them are hired as temporary workers, employers rarely take responsibility for their unemployment benefits. As a result, migrant workers are confronted with arduous living conditions once employment opportunities are not available for a very long period of time.

The mobility of migrant workers adds pressure to the implantation of the government's job expansion plans. At present, local governments do not include migrant workers in their employment expansion targets. The Central Government should track down migrant workers and make proper deployment of their reemployment.

To achieve a real economic revival with sound job growth, the government should learn from past experiences and minimize the impact of the financial crisis on the job market.

First of all, social security coverage must be broadened. The urban and rural social security system should be unified. International practices have proved that a major economic recession tends to be a crucial time to expand social security coverage and improve security levels.

When coping with the 1997 Asian financial storm, China had in the meantime built up a security system covering urban areas. Considering that migrant workers bear the brunt of unemployment, the government should extend its current urban social security network to rural areas, which would help lay a framework for a future social security system and coordinate urban and rural development.

Second, more breakthroughs are expected to take place in the fields of education, health care and old age protection, which are great concerns of the people. Once citizens are relieved of those burdens, they will be more willing to buy stuff. This will create a win-win scenario stimulating economic development at present and benefiting social security and public service in the long run. Consumption by the low-income group is likely to surge on sound social security. Moreover, if more of the central budget is spent on citizens' education, there will be more expenses and funds that can be redirected to consumption.

Third, public finance is required to shoulder a larger responsibility in supporting social security network expansion. In recent years, the labor market has been standardized, which has in effect added to enterprises' labor costs. Labor-intensive enterprises have since been heavily burdened by excessive labor costs. Judging from the enterprises' deteriorating performance, concerned government departments took a series of actions to help them by postponing their social insurance payments and incremental increases in the minimum wage. Those measures have exerted a positive influence on company performance at a time of economic downturn.

Therefore, if more public finance can be directed to social security, the enterprises' social security expenses will be reduced accordingly. In this way, if the same supportive measures can be maintained for a longer period, the conditions for enterprises will improve, and their expectations, along with investors' expectations, about their future expansion will become more stable. Hence more companies will be able to survive the financial turmoil, offering a healthier source of tax for the government. Boosting employment will ultimately create a scenario that benefits all sides.