From: Globe and Mail

http://www.theglobeandmail.com/servlet/story/GAM.20090228.RCOVER28/TPStory/TPComment?pageRequested=all

COVER STORY: CHINA

KICKING THE FACTORY ADDICTION

For more than a decade, the world gazed in awe as China grew into a manufacturing powerhouse. But suddenly, the world stopped buying and the juggernaut has become a model of overcapacity. Can a nation of fanatical producers be transformed into mass consumers? Marcus Gee visits the country's industrial heartland.

MARCUS GEE

February 28, 2009

BEIJING -- Zhang Lan is the picture of Chinese success. She grew up in the countryside, the daughter of university professors sent down to the farm during the Cultural Revolution to learn how the peasants lived.

When she grew up, she moved briefly to Canada, washing dishes and waiting tables in a Toronto restaurant.

Today she runs a chain of elegant nouvelle-Sichuan restaurants that employs 6,000 people. Her office has a big-screen TV, an Apple laptop and suite of designer furniture. Sleek assistants drift in and out with messages and cups of tea.

Just back from New Zealand, where she took a ride on China's America's Cup yacht, Ms. Zhang plans to get a boat of her own. She is learning to fly a helicopter, too. And for company, she plans to buy herself a pet crocodile. One of those little ones you keep in an aquarium, her visitor asks? "No," she replies, "I want a big one," and spreads her arms wide.

The drive and savvy of people like Ms. Zhang have helped carry China to giddy heights, transforming it from a land of Mao suits and bicycles to billionaires and bullet trains in the space of her adult lifetime.

But as the global crisis starts to hit the world's third-largest economy, its economic miracle is suddenly under a cloud.

Demand for made-in-China watches, hammers, Christmas lights and DVD players is drying up as Western consumers rein in their spending. Thousands of manufacturers have shut their doors, including half the country's toy factories. More than 20 million people have already been thrown out of work, spurring a mass reverse migration from the coastal export zones to the poor countryside.

Putting these people back to work is posing a challenge that goes far beyond just getting the factories up and running again.

The global crisis is exposing deep flaws in China's development model. As overseas shoppers have closed their wallets, China is learning the downside of a dependence on making cheap stuff for the rest of the world. Years of pumping up its industrial strength by throwing money into superhighways and supersized factories have left it too muscle-bound for its own good.

Now, like an athlete giving up on steroids, China is striving to wean itself off the high-octane cocktail of investment and exports and lean more on consumption, innovation and services. To thrive in the age of crisis and beyond, it needs a new model - one that produces fewer cement plants or toy factories and more gung-ho business people like Zhang Lan.

"The financial crisis is an opportunity to change the economic growth model," says Chang Xin, an economist at the Chinese Academy of Social Sciences. "How to make that opportunity into a reality is a big challenge for China."

China's current model springs from the reforms launched by Deng Xiaoping in 1978, opening China to the world and unleashing the power of the market. Deng consciously copied the success of neighbours such as Hong Kong, Taiwan and Singapore. They achieved spectacular growth in the 1960s and 1970s by exporting manufactured goods such as toys, clothing and, later, high-end electronics to the malls of the developed world. They also used their big pool of savings, the product of a famously high Asian savings rate, to invest heavily in roads, bridges, ports and strategic industries.

It was called the East Asian model of development and, for three decades, it seemed to work as well, if not better, for China than for the "little dragons" of Asia. China's gross domestic product per head grew tenfold and its overall GDP 12-fold. Hundreds of millions of Chinese rose out of absolute poverty. China became the workshop of the world, filling fleets of container ships with the products of its teeming coastal factories.

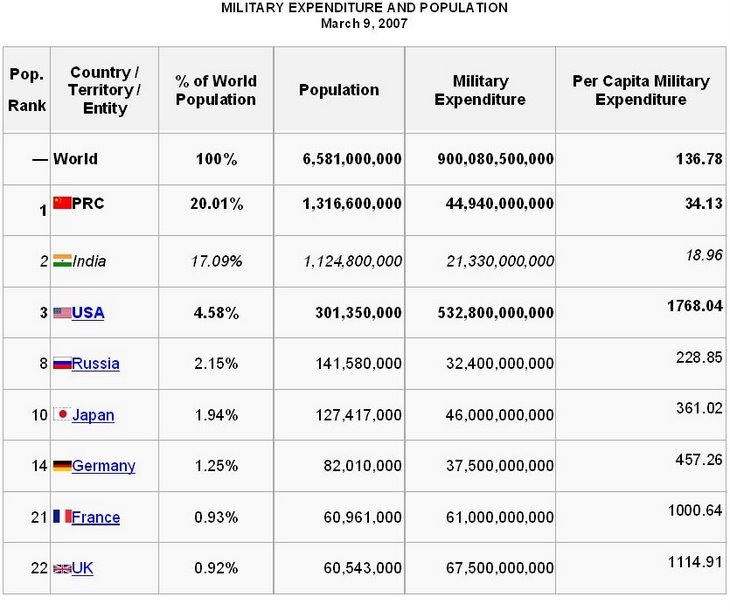

At the same time, capital investment by government and companies soared too, reaching more than 40 per cent of GDP, a far higher rate than the other East Asian dynamos in their era of maximum growth. Fixed-asset investment - in things such as land, building and machinery - has grown by a pell-mell annual rate of 20 per cent and more.

One result: China has no less than 80 car makers and thousands of steel mills. In the steel town of Fengrun about two hours from Beijing, for example, no less than 100 mills belch smoke into the sooty winter sky.

For decades, those car makers and smokestacks served a steadily growing overseas clientele. Until they went into reverse last fall, China's exports had been growing at a frantic pace for years.

Now, that heavy reliance on trade and investment is proving to be a weak spot. There is nothing wrong with investing, especially when companies are making fat profits and the economy is growing by double digits, as China's has until now. The problem in China is that much of the money is misdirected or simply wasted. State-run banks usually lend to state-run companies, or those with political connections. Much of the money pours into cement or chemicals or big export producers, which are favoured with government-subsidized land and energy. By contrast, smaller, more innovative companies have a hard time raising money in a country with an immature stock market.

Hence, the country's surplus of car makers and steel mills. How will they survive now that demand is falling for steel to make appliances for export and build new housing at home in China?

"Basically, you could get money for free in China as long as you built a factory," said Michael Pettis, a Peking University economist. "The Chinese financial system is geared up to create an unsustainable explosion of capacity. Just as the U.S. was the world centre of overconsumption, China was the world centre of overproduction. Both have to adjust."

In other words, China needs to become more like the rich economies of North America and Europe. That may stick in Beijing's throat at a time when those economies are suffering through their worst crisis in decades. Their model of development is looking pretty flawed too.

Western consumption clearly has its drawbacks. But Beijing's focus on government-directed industrial expansion overlooked the need to create a consumer class. And there's another problem: Heavy industry employs fewer workers than service industries. So in recent years, even as the economy boomed, employment growth has slowed and the income of the population has grown at only about half the rate of GDP.

"The end result of this pattern is that the Chinese economy has created this huge production capacity but has created a very limited consumption base," Yasheng Huang, a China watcher at the Massachusetts Institute of Technology, said in an e-mail interview. "This means that China is very vulnerable to the economic slowdowns in the U.S. and other rich countries."

China's consumption level is the lowest for any major economy. Both Chinese households and Chinese companies are fanatical savers. That means the economy can't rely on domestic demand when exports go soft.

Services, meanwhile, account for just 40 per cent of GDP, compared to 54 per cent in other middle-income countries and 70 per cent in high-income countries. There are more and more entrepreneurial companies like Ms. Zhang's restaurant chain group, but still not nearly enough. Only four million people work in China's banking and insurance industries, for example, a trifling number in a population of 1.3 billion.

Worse, service industries are often dominated by government-backed or government-owned firms with a stranglehold on the market. In mobile phones, one of China's most dynamic markets over the past decade, the dominant player is state-owned China Mobile.

Though Chinese products crowd store shelves around the world, China has produced no global brand such as Japan's Sony or South Korea's Samsung. And though Chinese firms are trying hard to move up the value chain, their record for innovation is poor. China has yet to produce a globe-girdling multinational such as India's Tata Group, though computer maker Lenovo is trying hard.

Many Chinese companies are still simply assemblers of other people's products - bikes from Taiwan or computers from Texas, put together by hand on a Chinese factory floor with parts imported from elsewhere. China spends 1.5 per cent of GDP on research and development, compared with 3 per cent or more in some developed economies.

China's leaders are well aware of the flaws in their economic model. The country's No. 2 leader, Premier Wen Jiabao, pronounced in 2007 that "there are structural problems in China's economy which cause unsteady, unbalanced, unco-ordinated and unsustainable development."

Only this week, the People's Bank of China, the country's central bank, remarked that "China has a problem of high savings and low consumption."

It noted that the share of investment in GDP has risen to 43.5 per cent in 2008 from 36.6 per cent in 1992, and the share of consumption has dropped to 48.6 per cent in 2008 from 62.4 per cent in 1992, well below the world average. This was "not conducive to the healthy and stable development of the economy."

Too true. Yet it remains to be seen whether Beijing will move quickly or decisively enough to correct the problem. To make it more tempting for Chinese to spend instead of save, Beijing has taken steps to improve its astoundingly weak social safety net.

Last month, for example, the government rolled out a new universal health care program, reasoning that people who have some insurance against illness will not have to save as much to pay for their care. It has also improved rural property rights to encourage country people to open their wallets and raised minimum factory wages to coax manufacturers to move up the value chain.

Still, the World Bank says that, so far, "there has been little rebalancing away from industry and investment towards services and consumption."

It recommends a series of measures: freeing the yuan - the Chinese currency - to rise in value, making Chinese exports less affordable to foreigners and shifting the balance away from export-led growth; shifting more government spending from investment to social welfare and education; liberalizing the banking system and stock markets so that smaller, more efficient firms can raise money and get loans more easily; dismantling monopolies and oligopolies that prevent competition in the services sector.

Taking these steps will be hard, especially in the midst of global recession. Rather than shifting away from exports, the government has quite naturally been doing everything in its power to help exporters from going under by, for instance, restoring tax rebates they used to enjoy. And far from slashing investment, it has promised to spend an impressive four trillion yuan ($740-billion) to stimulate the economy, much of it going on new roads, bridges and other infrastructure.

But, then, China has managed to reinvent itself before. Ms. Zhang, the restaurant chain owner, reminds her visitor that when she was growing up, China was "the sick man of the world." Her scholar parents were made to feed the pigs on the farm. It was forbidden to do business with foreigners or to run even so much as a private tea cart.

Today she is looking at buying six Swiss castles as part of a planned international expansion of her chain. Asked if she isn't afraid of the global economic storm, she says without bravado, "I don't know what it is to be scared."

If China managed to switch from the xenophobic Maoism of her youth to the modified capitalism of today, she is certain it can survive the current storm and move forward. Who would dare to say she is dreaming?